Why a Personal Loan Could Be Your Kitchen’s Best Friend

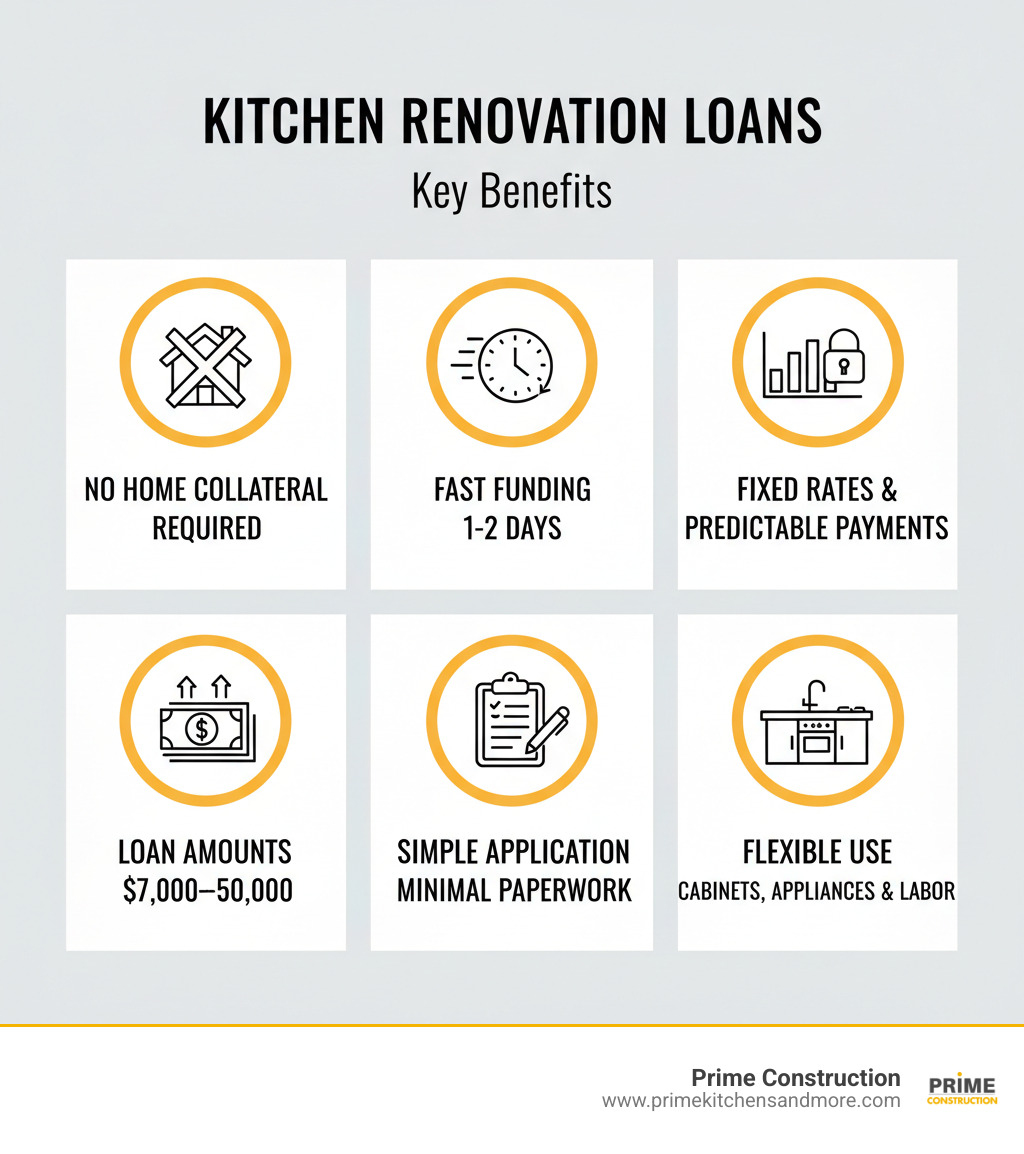

Apersonal loan for kitchen remodelprojects offers a fast, flexible way to fund your renovation without using your home as collateral. Here’s what you need to know:

Quick Answer: Personal Loan Essentials

- Loan amounts: Typically $7,000 to $50,000

- Funding speed: Often 1-2 business days after approval

- No collateral required: Your home isn’t at risk

- Fixed rates: Predictable monthly payments over 2-7 years

- Simple process: Less paperwork than home equity loans

You’ve been dreaming of a new kitchen—sleek countertops, modern cabinets, and an island for family gatherings. But how do you pay for it? The average kitchen remodel can cost between $15,000 and $50,000 or more. While many homeowners look to home equity or savings, there’s a faster, simpler path.

Personal loans are a popular choice for kitchen renovations. They don’t require a home appraisal or use your house as collateral. Unlike credit cards with high interest rates, personal loans offer lower, fixed rates and predictable monthly payments.

For busy Orlando homeowners, the streamlined application is a key benefit. Lenders can often approve and fund your loan within days, not weeks. This means you can start your renovation sooner.

But is a personal loan right for your kitchen remodel? It depends on your credit, budget, and timeline. Let’s explore how personal loans work, what they cost, and how to use them for your renovation.

Understanding Your Financing Options: Personal Loan vs. Equity-Based Loans

When you’re ready to transform your kitchen, the financing options can feel overwhelming. Let’s break down the difference between personal loans, HELOCs, and home equity loans.

The main difference comes down to one question:Do you want to use your home as collateral or not?

Apersonal loan for kitchen remodelprojects is anunsecured loan, meaning you don’t put up any collateral. Your home isn’t at risk. Approval is based on your credit score, income, and existing debts. If you default, your credit score takes a hit, but the lender can’t take your house. You typically borrow $7,000 to $50,000 and repay it over 2 to 7 years with fixed monthly payments. Interest rates are higher than secured loans but much lower than credit cards.

Equity-based loans aresecured loans, using your home as collateral. This includeshome equity loansandHELOCs(Home Equity Lines of Credit).

Ahome equity loanprovides a lump sum of cash with a fixed interest rate, like a second mortgage. It’s predictable and ideal when you know the exact cost of your remodel.

AHELOCis a flexible line of credit secured by your home. You draw funds as needed and only pay interest on what you use. However, interest rates are often variable, so payments can change.

The biggest risk with equity-based loans is foreclosure if you can’t make payments. Personal loans don’t carry this risk. Additionally, personal loans fund in days with simple paperwork, while equity loans require appraisals and take weeks to close.

Here’s how these options stack up side by side:

| Feature | Personal Loan | Home Equity Loan | HELOC |

|---|---|---|---|

| Collateral | None (unsecured) | Home (secured) | Home (secured) |

| Interest Rate | Fixed, generally higher than secured loans | Fixed, generally lower than personal loans | Variable, generally lower than personal loans |

| Funding Speed | Fast (days) | Slower (weeks, requires appraisal) | Slower (weeks, requires appraisal) |

| Access to Funds | Lump sum | Lump sum | Revolving line of credit |

| Equity Required | None | Yes, significant equity | Yes, significant equity |

| Application | Simpler, fewer documents | More complex, requires home appraisal | More complex, requires home appraisal |

| Repayment | Fixed monthly payments | Fixed monthly payments | Variable payments (interest-only option often) |

| Risk | No risk to home | Home at risk of foreclosure | Home at risk of foreclosure |

If you’re a newer homeowner without much equity, or if you’re uncomfortable putting your home on the line, a personal loan is often the best bet. If you have substantial equity and want the lowest possible rate, a home equity option could save you money.

Why Choose a Personal Loan for Your Kitchen Remodel?

Now that we understand the financing landscape, let’s zoom in on why apersonal loan for kitchen remodelmight be the perfect fit. After 15 years of helping Orlando homeowners, we’ve seen how the right financing can improve the entire renovation experience.

- Fast Funding: Instead of waiting weeks for an equity loan, personal loans are often approved and funded in a few days. This speed is crucial when your contractor is ready or you find a great deal on appliances.

- No Home Collateral Required: Your home is your biggest asset. With an unsecured personal loan, you don’t put it on the line. This eliminates the risk of foreclosure, offering significant peace of mind.

- Fixed Monthly Payments: You’ll know your exact payment from day one. Apredictable budgetwith no surprise rate hikes makes financial planning simple.

- Simpler Application Process: The process is straightforward, requiring basic documents like ID and proof of income. There’s no need for a home appraisal, saving you time and hassle.

While personal loans offer these benefits, they do have trade-offs. Interest rates can be slightly higher than secured loans, and repayment terms are shorter (2-7 years), which may result in higher monthly payments. For many, however, the speed, simplicity, and security are well worth it.

When Does a Personal Loan Make Sense for a Kitchen Remodel?

Apersonal loan for kitchen remodelis an excellent choice in several scenarios:

- You have limited home equity.If you’re a new homeowner or haven’t built up much equity, a personal loan allows you to renovate without waiting.

- You need funds quickly.For urgent repairs or to seize a contractor’s availability, the fast funding of a personal loan is unbeatable.

- You prefer not to use your home as collateral.Many homeowners value the security of keeping their home separate from their renovation debt.

- You have a project with a clear, fixed budget.A personal loan provides a lump sum that aligns perfectly with a detailed quote, like those we provide at Prime Kitchens And More. This makes it a straightforward financing solution for a well-planned project.

Planning and Applying for Your Kitchen Remodel Loan

A successful kitchen remodel starts with a solid financial plan. Before you start picking out cabinet colors, secure the right financing and plan your budget. When considering apersonal loan for kitchen remodel, budgeting accurately ensures you borrow the right amount—not too little and not too much.

Step 1: How to Budget for a Kitchen Remodel

Understanding typical costs helps set realistic expectations. In Orlando, remodels often range from $15,000 to $50,000.

- Cabinet Costs: As the backbone of your kitchen, quality custom cabinets can range from $10,000 to $30,000.

- Countertop Costs: Materials like granite or quartz typically cost between $3,000 and $10,000.

- Appliance Costs: A new suite of quality appliances can run from $5,000 to $15,000. ENERGY STAR models offer long-term savings.

- Labor Costs: Expect labor to be 20-35% of the total budget, with professional rates in Orlando from $75 to $150 per hour.

A personal loan can cover all these expenses, from materials to labor. Crucially, always include acontingency fundof 10-20% for unexpected issues like outdated wiring or hidden water damage.

Step 2: The Personal Loan Application Process

With your budget set, the application process is simple.

- Check Your Credit:Lenders will review yourcredit score(most look for 620+) anddebt-to-income ratio. A higher score usually means better rates. Check your score beforehand and work to improve it if needed.

- Get Prequalified:Prequalification gives you loan estimates from various lenders without affecting your credit score. This allows you tocompare lenders—banks, credit unions, and online options—to find the best rates and terms.

- Gather Documents:Have yourrequired documentsready to speed up the process. This includes proof of identity, income verification (pay stubs, tax returns), and bank account information.

- Apply and Receive Funds:After you formally apply, the lender performs a hard credit inquiry. Once approved, you can expect toreceive fundsvia direct deposit within 1-2 business days, allowing you to start your renovation immediately.

Making Your Loan Work for You: Repayment and Value-Adding Strategies

You’ve secured yourpersonal loan for kitchen remodel, and now it’s time to manage it wisely. Personal loan repayment is straightforward. Most come withfixed interest ratesandtypical repayment termsof 1 to 7 years. This predictability makes budgeting simple. Plus, most lenders don’t chargeprepayment penalties, so you can pay off your loan early and save on interest if you get a bonus or tax refund.

Beyond repayment, think about the long-term value you’re creating.Energy efficiencyis great for your wallet. Upgrading to ENERGY STAR certified appliances can significantly reduce your utility bills. When we design kitchens for our Orlando clients, we often recommend energy-efficient features like modern appliances, new insulation, and LED lighting that pay for themselves over time.

Can I combine a personal loan with government incentives?

Yes. A key feature of apersonal loan for kitchen remodelis that the funds areunrestricted. This flexibility allows you to combine your loan with government incentives for energy-efficient home improvements.

Your personal loan covers the upfront costs, while rebates andtax creditsoffset those expenses later. When you purchase appliances eligible forENERGY STAR rebates, you can often claim cash back from federal, state, or local utility programs. These incentives can cover appliances, HVAC systems, and insulation. You can explore available programs through resources like theENERGY STAR Rebate Finder.

This approach lets you start your project immediately while using incentives to reduce your overall investment. At Prime Kitchens And More, we guide clients in Orlando, Orange County, and Seminole County to integrateenergy-efficient appliancesinto their designs, creating kitchens that are beautiful, functional, and cost-effective.

Frequently Asked Questions about Kitchen Remodel Loans

We talk to homeowners throughout Orlando and have noticed the same questions come up when people consider apersonal loan for kitchen remodel. Let’s tackle the big ones.

How much can I borrow for a kitchen remodel?

Personal loan for kitchen remodelamounts typically range from $1,000 to $100,000, with most projects falling in the $7,000 to $50,000 range. The amount you can borrow depends on your credit score, income, and debt-to-income ratio. A stronger financial profile will qualify you for larger loans and better rates. The key is toalign the loan amount with your carefully planned budget. We recommend borrowing only what you need based on a detailed quote to avoid paying unnecessary interest.

How quickly can I get funds from a personal loan?

Unlike home equity loans that can take weeks, personal loans are known for their speed. Most lenders can approve your application and deposit funds into your account within1 to 2 business days. Some even offer same-day funding. This rapid turnaround is a major advantage, allowing you to start your renovation without delay and secure a contractor’s availability.

Will taking out a personal loan hurt my credit score?

Applying for a loan involves ahard inquiry, which can temporarily lower your credit score by a few points. This is normal. The long-term impact depends on your repayment habits. Making on-time payments every month will build a positive payment history and can actually strengthen your credit score over time. Conversely, late or missed payments will damage your score. If you manage the payments responsibly, apersonal loan for kitchen remodelcan be a positive for your credit health.

Conclusion

Your dream kitchen is within reach. Apersonal loan for kitchen remodelprojects offers a straightforward path to financing your renovation. As we’ve discussed, the key advantages for Orlando homeowners are clear:speedof funding, asimpleapplication, andno home collateralrequired. This means you can start your project in days, avoid complex paperwork, and keep your most valuable asset safe.

While rates may be slightly higher than secured loans, the benefits of predictable payments and quick access to funds make it a worthwhile trade-off for many. The key is to budget carefully, compare lenders, and make timely payments. Approached correctly, a personal loan is a powerful tool for changing your home.

At Prime Kitchens And More LLC, we’ve spent 15 years helping families in Orange County, Seminole County, and across the Orlando area bring their kitchen visions to life. We understand that smart financing is as crucial as the design itself. We’re here to guide you through every step, from planning to completion.

Ready to create a kitchen where memories are made?Learn more about your kitchen remodel financing optionsand find how Prime Kitchens And More can help you build a space you’ll love for years to come.