Your Kitchen Renovation Loan Options at a Glance

A kitchen remodel can transform your home. It adds beauty, function, and even boosts its value. But making that dream kitchen a reality often means finding the right financial help. This guide will walk you through the options.

Securing the rightkitchen renovation loanis a key step. It helps you manage costs and spread payments over time. For busy Orlando homeowners, knowing your choices upfront saves time and stress.

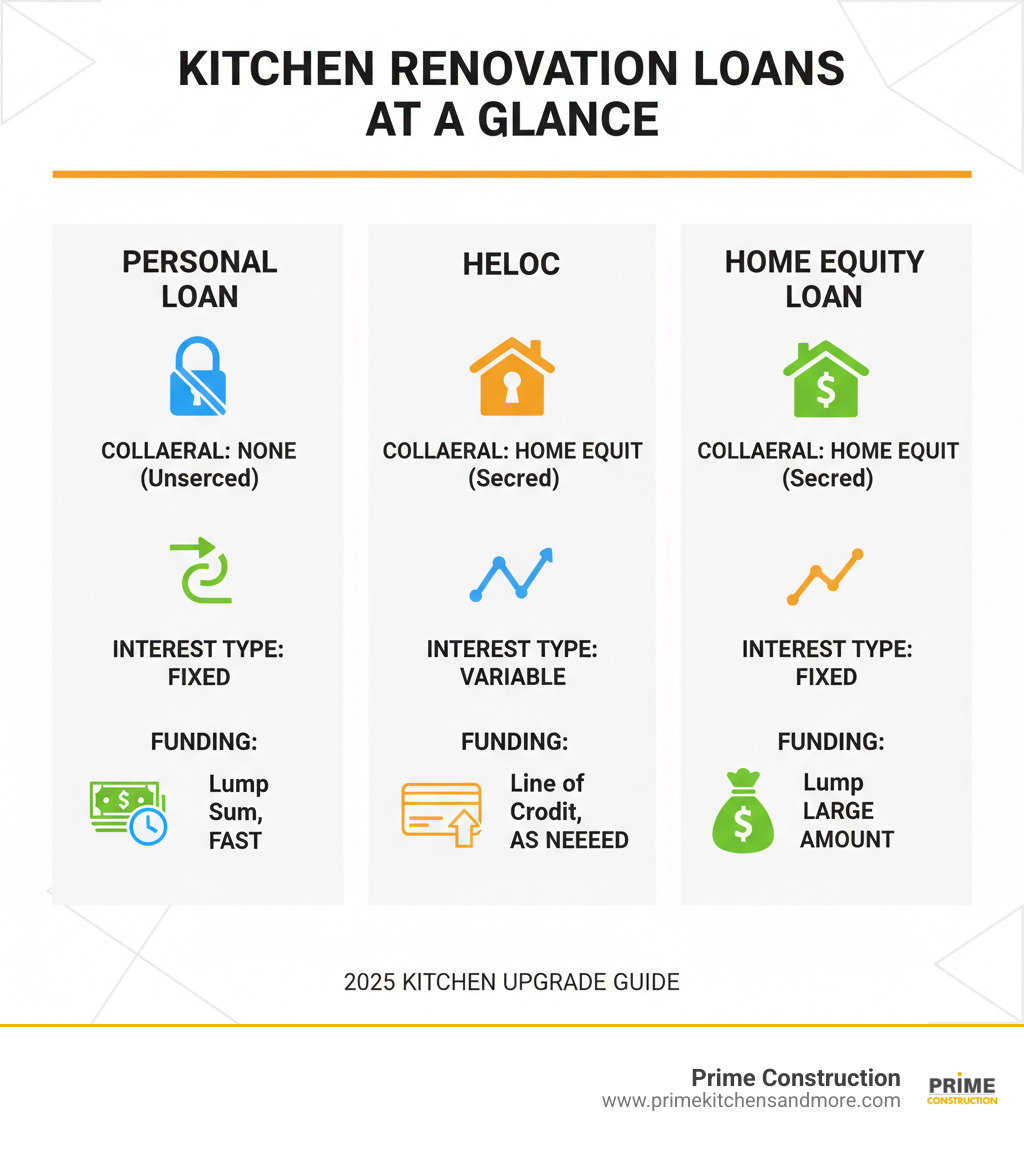

Here’s a quick look at the most common ways to finance your kitchen project:

- Personal Loans:These areunsecured, meaning no collateral (like your home) is needed. They offer quick funding and fixed interest rates. Best for smaller projects or if you have little home equity.

- Home Equity Lines of Credit (HELOCs):These aresecuredby your home’s equity. They act like a credit card, letting you draw funds as needed. Interest rates are usually variable. Great for phased projects.

- Home Equity Loans:Alsosecuredby your home. You get a lump sum upfront with a fixed interest rate. Good for larger, one-time projects if you have significant home equity.

- Credit Cards:Can be useful forsmallupdates or emergency purchases. However, they usually have very high interest rates. Use with caution.

- Government-Backed Loans:Programs like FHA 203(k) loans can bundle renovation costs into your mortgage. These are for larger structural changes or significant repairs.

Choosing the best option depends on your project’s size, your home equity, and your financial situation.

Understanding the Costs and ROI of a Kitchen Remodel

Figuring out kitchen remodel costs can feel overwhelming, but understanding the numbers upfront helps you make smarter decisions about yourkitchen renovation loanand overall project.

Kitchen renovation costs vary widely. Asmall cosmetic updatemight run $10,000 to $20,000 for fresh paint, new hardware, and updated lighting. Amid-range remodelwith new cabinets, appliances, and fixtures can range from $30,000 to $50,000.

For luxury materials, custom features, and top-of-the-line appliances, costs can easily reach $75,000 to $100,000 or more. Thenational averagefor a major kitchen renovation is around $79,982.

In Orlando and surrounding areas like Winter Park, Apopka, and Kissimmee, costs can shift with local market conditions, making local estimates essential. For specific details about what to expect in our area, check out our guide onKitchen Remodeling Cost Orlando.

Cabinets typically eat up almost 30% of your total budget—the biggest single expense. Smart choices here, like ready-to-assemble (RTA) cabinets, can stretch your dollar, costing half as much as full custom options while delivering great quality and style.

A kitchen remodel isn’t just about spending money; it’s aboutinvesting in your home’s future. A great kitchen update increases property value and attracts buyers with modern fixtures, finishes, and new appliances.

Want to understand more about why this investment makes sense? Our guide onTop Reasons to Do a Kitchen Remodeling Project in Your Homebreaks it down beautifully.

Key Factors That Influence Your Budget

Several key elements will shape your final costs and help you plan your financing strategy:

Scope of your remodelis the biggest factor. A cosmetic refresh with paint and new hardware costs far less than a full gut renovation involving structural changes.

Kitchen sizedirectly impacts material and labor, as a larger space requires more of everything.

Material choicesoffer budget flexibility. Countertops range from affordable laminate to luxury marble, and custom cabinets cost more than RTA options.

Appliance selectioncan add thousands to your project, as high-end, smart appliances carry premium price tags.

Labor and contractor feesvary by complexity and expertise. Our 15 years of experience ensures top-tier craftsmanship and lasting results.

Unforeseen issuescan arise, especially in older homes. We recommend a 10-20% contingency fund for hidden problems like outdated wiring or plumbing.

Looking for inspiration that fits various budgets? Browse ourKitchen Remodel Ideasfor creative solutions.

The Potential Return on Investment

Kitchen remodels are smart financial moves. The return on investment varies, but the numbers are encouraging:

Minor kitchen remodelsdeliver impressive returns, often around96.1%. These projects include repainting, cabinet refacing, and replacing select appliances for a fresh look without breaking the bank.

Major kitchen remodelsrecoup about49.5% of costs. While this seems lower, the remaining value comes from increased home saleability and your daily enjoyment.

Increased property valueand faster sales prove a kitchen’s worth. An updated kitchen stands out in Orlando’s competitive market and wins over buyers.

Expanding your kitchencan boost ROI by44% higherthan average. Opening up the space creates the modern feel that buyers desire.

At Prime Kitchens and More, we specialize in kitchen and bathroom design using premium materials that maximize both your daily enjoyment and long-term home value. Learn more about ourKitchen Remodeling Services.

Your Guide to the Best Kitchen Renovation Loan Options

Now, let’s explore how to pay for your dream kitchen. Finding the rightkitchen renovation loanis about matching your needs with the best available option.

Financing splits into two camps: secured and unsecured. Secured loans (home equity loans, HELOCs) use your home as collateral, offering lower interest rates. Unsecured loans (personal loans) don’t require collateral but have higher rates to balance the lender’s risk.

You’ll also see fixed vs. variable rates. Fixed rates provide predictable payments, while variable rates can fluctuate with the market.

| Loan Type | Collateral Required | Interest Rate Type | Best Use Case | Pros | Cons |

|---|---|---|---|---|---|

| Personal Loan | No | Fixed | Small to mid-size projects, no home equity available | Fast funding, no home as collateral, predictable payments, simple application | Higher interest rates than secured loans, loan amounts may be limited |

| Home Equity Loan | Yes (your home) | Fixed | Large, one-time projects, significant home equity | Lower interest rates, lump sum funding, predictable payments, interest may be tax-deductible | Home as collateral (risk of foreclosure), longer application process, can take weeks to fund, equity required |

| HELOC | Yes (your home) | Variable (usually) | Phased projects, ongoing renovation needs | Flexible access to funds, lower interest rates, interest may be tax-deductible | Variable interest rates (payments can fluctuate), home as collateral, draw period followed by repayment period, potential for interest-only payments during draw period leading to higher principal later |

Home Equity Loans and HELOCs

Home equity is your home’s value minus your mortgage balance. Lenders typically let you borrow up to 80% of your home’s value, known as the loan-to-value (LTV) ratio.

Ahome equity loanis a lump-sum loan with fixed monthly payments, ideal when you know the total remodel cost. The interest may be tax-deductible for home improvements (check with a tax advisor).

AHELOCis a revolving line of credit backed by your home. You draw funds as needed during a “draw period” (often 10 years), typically making interest-only payments. Afterward, you enter a “repayment period” to pay back principal and interest.

The main advantage islower interest rates. The major risk is that your home is collateral; you could lose it if you default. The application process is also longer, often taking several weeks. For help calculating your home’s equity, check out this guide onhow to calculate home equity.

Personal Loans

Personal loans are simple, unsecured options that don’t put your home at risk. They rely on your creditworthiness, not your assets.

Personal loans are attractive for theirstraightforward nature. You get a lump sum for all project costs, and the fixed rate and payments simplify budgeting.

Online lenders offer quick approvals, often up to $40,000. While rates are higher, you getfast fundingwithout risking your home, which provides valuable peace of mind. For more comprehensive information about home improvement financing, exploremore on home improvement loans.

Government-Backed Loans

The government offers unique programs like theFHA 203(k) loan, which lets you combine a home purchase and renovation costs into one mortgage or finance major renovations on a current home.

There are two versions: theLimited 203(k)for non-structural work up to $35,000 and theStandard 203(k)for major structural changes with a $5,000 minimum.

These loans are best for extensive renovations or fixer-uppers. Work must meet FHA guidelines and usually requires professional contractors. This is a game-changer for major structural changes. Learn more atLearn about the 203(k) loan program.

Title 1 Property Improvement Loansare another FHA-backed option that don’t require rolling costs into your mortgage.

Our experience withCustom Kitchen Design Orlando FL Guideensures your design plans align with any program requirements if you choose this route.

Other Financing Strategies

Credit cardscan work for small purchases, especially with a 0% intro APR. Be cautious, as standard rates are high (20-25%) and expensive for long-term debt.

Many retailers offer0% intro APRdeals on items like appliances. Paying it off before the promo ends is a smart move.

Contractor financingoffers convenience. We may offer financing or work with partner lenders to simplify the process. Always compare these offers with other lenders for competitive terms.

Paying with cashis the simplest, debt-free option. You avoid interest and may get a contractor discount. If your project isn’t urgent, saving up is wise. For budget-friendly approaches, check out ourAffordable Kitchen Makeoverguide.

How to Secure the Best Financing for Your Project

Securing the rightkitchen renovation loanis foundational to your project’s success. Approach it strategically instead of grabbing the first offer.

Start with an honest financial assessment. Understand your monthly spending to ensure a new loan payment fits comfortably in your budget without causing stress. Your new kitchen should bring joy, not financial anxiety. If the payment strains your budget, you’re borrowing too much.

We always advise homeowners tobudget for the unexpected. With 15 years of experience, we know surprises like outdated wiring can happen. A 10-20% contingency fund isn’t pessimistic—it’s smart planning.

Shop for your loan like you would for cabinets. Compare offers from banks, credit unions, and online lenders to find the best fit and rates.

For a complete roadmap from planning to completion, check out our guide onHow to Remodel Your Kitchen.

Improving Your Credit Score for a Better Kitchen Renovation Loan

Your credit score is your financial reputation. A strong score saves you thousands on akitchen renovation loanthrough lower interest rates.

Check your credit report from all three bureaus for free. You might find errors you can dispute to improve your score.

Paying all bills on time is the biggest factor in your credit score. Late payments hurt your score for years, so be consistent.

Paying down high credit card balancesquickly improves your credit utilization ratio, which lenders like to see.

Your debt-to-income ratio is also important. A lower ratio shows lenders you can handle another payment.

Here are 3 quick ways to boost your credit score before applying:

- Pay down your highest interest credit card– this gives you the biggest bang for your buck

- Become an authorized useron someone else’s account (if they have excellent credit habits)

- Set up automatic paymentsto never miss a due date again

How to Compare Offers for a Kitchen Renovation Loan

Comparing loan offers is simple if you know what to look for.

Focus on theAnnual Percentage Rate (APR). It includes interest and fees, giving you the total cost of the loan.

Loan termsare also crucial. Shorter loans have higher payments but cost less in total interest. Longer loans have lower payments but cost more over time. Choose what fits your budget and goals.

Watch for hiddenorigination fees, closing costs, and application fees. Some lenders hide high fees behind low advertised rates.

Beware ofprepayment penalties. If you plan to pay your loan off early, ensure your lender doesn’t charge a fee for it.

Calculate the total cost over the loan’s life (monthly payment x number of months + fees) to understand the true cost of your renovation.

Avoiding Common Financing Pitfalls

With 15 years of experience in Orlando, we’ve seen common, avoidable financing mistakes. A little planning prevents them.

Borrowing more than you needis a common trap. It’s tempting, but every extra dollar accrues interest for years.

Read the fine print. Understand all terms, fees, and penalties for missed payments to avoid surprises.

We can’t stress this enough:budget for the unexpected. A contingency fund prevents surprise repairs from forcing you into more debt or halting your project.

Choosing the wrong loan typeis a common error. A personal loan is fine for small updates, but a HELOC could save you thousands on a major renovation.

Finally,don’t ignore your credit score. Rushing to apply without checking your credit can lead to high-interest loans that a few months of credit improvement could have avoided.

Your kitchen renovation should be exciting, not stressful. Taking the time to get your financing right sets you up for a smooth project and years of enjoying your beautiful new space.

Frequently Asked Questions about Kitchen Remodel Financing

Here are answers to common questions from Orlando homeowners about financing kitchen remodels.

What is the easiest loan to get for a kitchen remodel?

Personal loansare often the easiestkitchen renovation loanto get. You can apply online, get approved in hours, and receive funds as soon as the next business day.

Online lenders have streamlined the process, requiring basic financial info without a home appraisal. This is much faster than the process for a home equity loan.

The trade-off is higher interest rates. But for those with decent credit who need funds quickly, personal loans offer best convenience, allowing projects to start in weeks, not months.

Can I get a kitchen renovation loan with bad credit?

Yes, but it’s more challenging. Be realistic about your options and expect higher costs.

Subprime lenders work with borrowers with scores below 600, but interest rates will be significantly higher. It can still make sense if the renovation is urgent or adds significant value.

Secured options like a home equity loan or HELOC are more accessible with bad credit because your home acts as collateral, reducing lender risk. This puts your home on the line.

A co-signer with good credit is another strategy. They agree to take responsibility for payments, which can help you qualify for better rates. It’s a big ask, but family members often help.

The best approach is to improve your credit score before applying. Waiting a few months to pay down debt and catch up on payments can significantly improve the rates you’re offered.

Is it better to save up or finance a kitchen remodel?

This is a common question without a single answer. It depends on your situation, but here’s our perspective from 15 years of experience.

Saving upis ideal if your project isn’t urgent. You’ll avoid interest and have financial freedom. If you can save the full amount in 12-18 months, this is a great option.

But sometimesfinancingis more strategic. It makes sense if your kitchen is falling apart, you plan to sell soon in Orlando’s competitive market, or you want to secure a contractor’s availability.

Consider the opportunity cost. If your investments earn more than the loan’s interest rate, financing might be smarter than liquidating assets.

With stable income and manageable debt, akitchen renovation loanlets you enjoy your new space now while spreading out the cost. A good remodel in Orlando also offers excellent ROI.

A combination approach is often best: save for a large down payment and finance the rest. This minimizes interest and protects your emergency fund.

Conclusion

Starting on a kitchen remodel is one of the most rewarding home improvement projects you can undertake. It’s not just about creating a beautiful space it’s about building the heart of your home where memories are made over family dinners and morning coffee.

Finding the rightkitchen renovation loandoesn’t have to be overwhelming. We’ve walked through everything from quick personal loans to equity-based options like HELOCs and home equity loans. We’ve explored government-backed programs and even touched on creative financing strategies. The key is matching the right loan to your specific situation.

There’s no one-size-fits-all solution. A small cosmetic refresh might be perfect for a personal loan, while a major renovation could benefit from the lower rates of a home equity loan. The urgency of your project, your available equity, and your comfort level with debt all play important roles in this decision.

The planning phase is just as crucial as picking the right financing.Improving your credit scorebefore you apply can save you thousands in interest. Shopping around for the best rates and terms is time well spent. And that contingency fund we keep mentioning? It’s not optional it’s your safety net against those surprise issues that old homes love to spring on us.

At Prime Kitchens and More LLC, we’ve been helping Orlando families transform their kitchens for 15 years. We’ve seen how the right financing can make the difference between a dream deferred and a dream realized. Our team understands the local market in Orange County, Seminole County, and beyond. We know what works and what doesn’t when it comes to both design and financing.

Your new kitchen is waiting, and with the right financial plan in place, you can move forward with confidence. The investment you make today will pay dividends in daily enjoyment and increased home value for years to come.

Ready to turn your kitchen dreams into reality?Get your free quote for your Orlando kitchen remodeltoday! For comprehensive guidance on every aspect of financing your project,Start planning your dream kitchen with our ultimate financing guide.